In most organization Payroll function is performed by the department of the Finance division based on manual instructions from the Human Resource Division. In Accord e-HR, Payroll is an integral part of the eHR and authorized data entered into the employee file automatically effects payroll on approval.

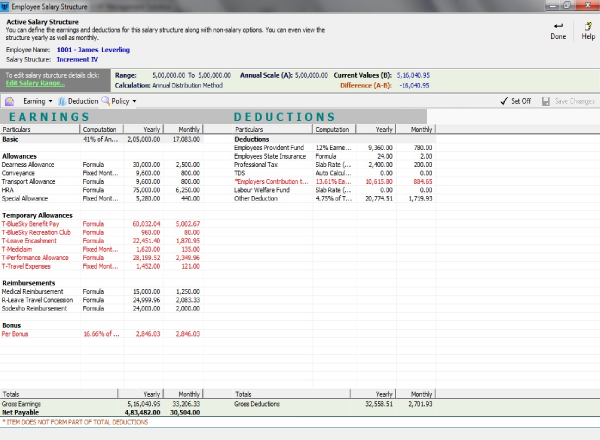

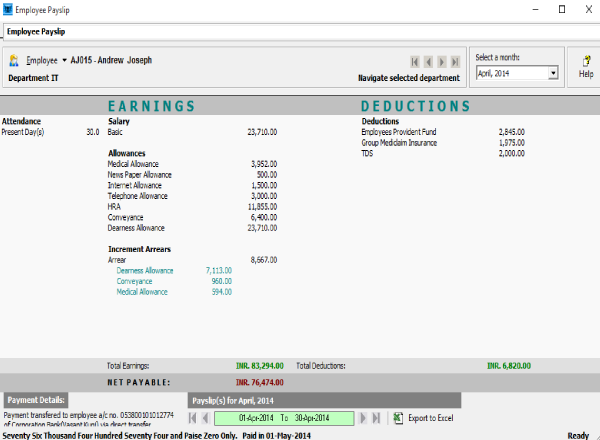

The calculation and payment of wages, salaries and pensions including deductions, allowances, overtime etc. in accordance with Organizational policies and government regulations are managed by the comprehensive Payroll Management System from called PayCare.

Comprehensive Payroll Statutory Compliance with regular updates on changes in government regulations.

Compute Employee Professional Tax, Employee Provident Fund, ESIC, Labour Welfare Fund, Pension and more with accuracy and generate relevant forms and challans as per required format of the state or region.

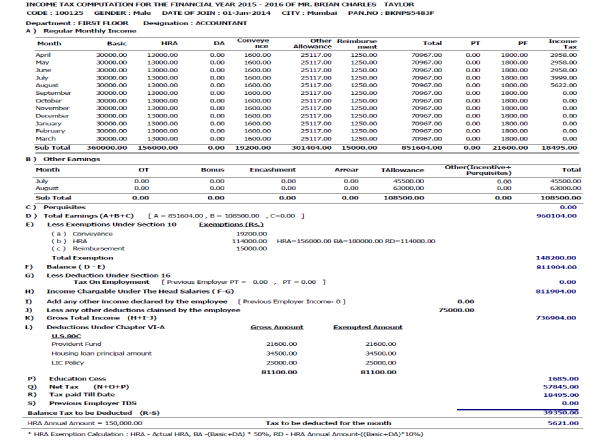

PayCare's Tax module can compute tax due based on prevelant taxation laws. Tax module's extended features also cover 'Form16', 'Form24', 'Provdent Fund', 'ESIC Statements' generation, Income statement and tax projectionand more. The facility to generate ASCII file for validating with NSDL utility is also available for payment of eTDS which is a mandatory norm for Indian companies.

Intelliob HR Payroll System is a comprehensive HR and Payroll Management solution. At the time of setting up PayCare for your organization, Intelliob technical and functional team guide you through payroll aplication implementation and payroll data migration process and setup screens that will accept global terms like your organization details and create master databases of employees, designations, departments, leaves, pays, pay dates, holidays, taxation, credits, deductions, et al.

This information is secured and can only be modified by authorized personnel. With initial master and employee data setup and parellel run done, PayCare Payroll delivers true out-of-the-box experience. For regular usage, authorized users must log in to PayCare.

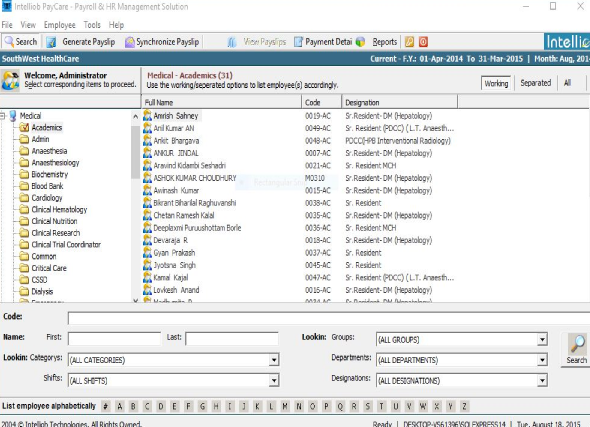

This module allows for the adding or modifying employee details. All employee information required by your organization will be entered here. This module also allows for updating employee information like marital status, employment status, residence, emergency contacts, etc.

Payroll's AutoSync system provides a secure and faster way to synchronize all your HR data throughout the enterprise. Now, when an employee is transferred to another location, his/her HR records also travel to the new location. No matter how many branch offices your organization may have across the globe, PayCare ensures that the right information is available to the right people at the right time.

PayCare makes attendance monitoring a snap. Attendance can be recorded either through manual entry or any automated system like biometric devices, or swipe cards. PayCare computerizes leave applications and employee with sanctioned leaves will be marked as 'On Leaves' automatically. Apart from common types of leaves, PayCare can adapt to any kind of leave structure your organization may utilize.

The attendance and leave records required for payroll generation can be captured via various options like importing time records from biometric or card based hardware systems or by way of excel import and also from the employee self service portal.

PayCare's Tax module can compute tax due based on prevelant taxation laws. Tax module's extended features also cover 'Form16', 'Form24', 'Provdent Fund', 'ESIC Statements' generation, Income statement and tax projectionand more. The facility to generate ASCII file for validating with NSDL utility is also available for payment of eTDS which is a mandatory norm for Indian companies

Comprehensive Payroll Statutory Compliance with regular updates on changes in government regulations.

Compute Employee Professional Tax, Employee Provident Fund, ESIC, Labour Welfare Fund, Pension and more with accuracy and generate relevant forms and challans as per required format of the state or region.

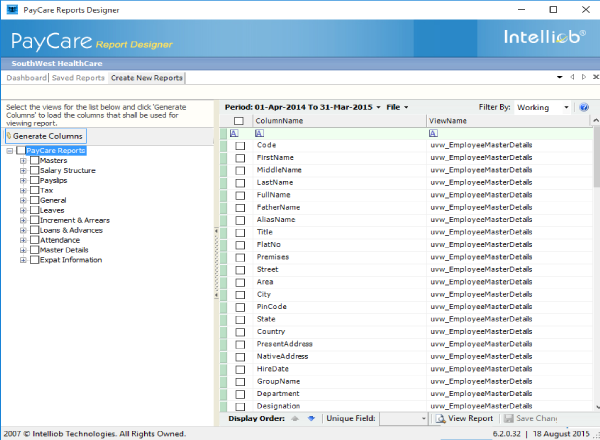

The data so maintained in PayCare is used to provide a host of routine and special reports as well as MIS information. Regular reports like attendances, overtime, achievements, advances, loans, etc. are all provided for.

PayCare maintains service records as well. Overall HR costs, employee Cost To Company, departmental costs, Income-Expenditure analysis, and a host of such MIS tools are also provided with PayCare.This empowers your organization to streamline project management towards better bottom lines.

The employee Self Service module of PayCare Payroll System is designed to be an online payroll information portal for employees that gives complete details like employee attendance & time sheet regularization, online leave application and approval by managers, investment declaration and Tax Projection, employee related reports on leaves, payslips and much more.

This comrehensive work flow based system comes with capabilities to manage approvals and alerts in realtime.

PayCare payroll features advanced Challenge-Response and encryption alogrithms, and can integrate seamlessly with horizon technologies like biometric and smart cards systems. Its powerful Authentication and Authorization engine ensures that no user can view or edit material that is not meant for his/her use. Needless to say, PayCare also features automatic backup systems that encrypt, archive and protect your valuable data.